Human Capital Intel - 1/14/2025

Hidden labor market uncertainty | Companies cut managers | Fortune500 RTO offensive | Quit rates and salary expectations tell conflicting stories

Welcome to the latest edition of Human Capital Intelligence. As always, we would love to hear from you at ken@stibler.me with news ideas, feedback and anything else you find interesting.

Sent this by a friend? Sign up here to receive HCI in your inbox every week.

By Ken Stibler; Powered by Reyvism Analytics

Strong labor figures mask talent mismatch and uncertainties ahead

Despite record-high vacancy rates plaguing many cities, the Wall Street Journal reported that many companies are struggling to find “premium” workspace that meets their exacting standards - modern buildings with outdoor spaces, upscale amenities, and prime locations near transport hubs.

Their complaints mirror the paradox seen in the labor market, where your experience hiring and the stories of your kids or friends’ kids seem to tell two different stories - mainly 1.6 million Americans who have been searching for work for six months or longer, despite persistent employer difficulties finding qualified talent. In reality, it’s more selectivity than shortage.

In the context of a labor market that’s not really working, December’s employment figures were a mirage of a robust labor market. The 256,000 jobs added blew past economists expectations of 165,000 along with the idea that forecasters have a good understanding of what’s happening to begin with.

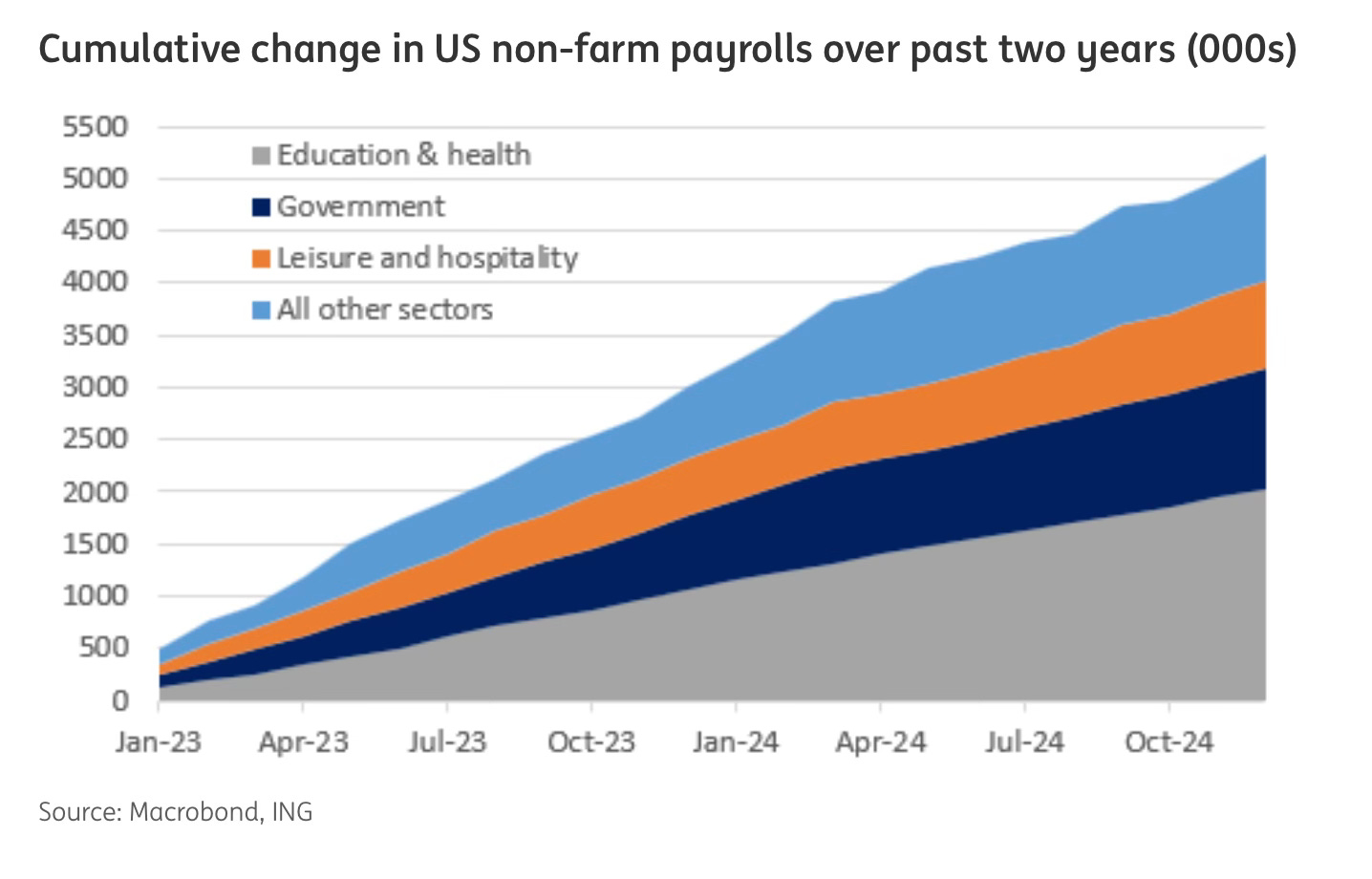

Aggregates are particularly un-helpful as local conditions vary greatly across states and industries. Job creation remains heavily concentrated, with healthcare, leisure and hospitality, and government sectors accounting for 78% of all jobs added over the past two years, while traditional growth engines like business services, technology, and manufacturing have a net negative contribution to overall employment gains.

Given the notorious acyclicality - and unsustainability - of healthcare and government spending, the job numbers are a rather ominous sign of market inefficacy and unforeseen shocks than an economy ready to boom.

JPMorgan and big banks prepare for flood of deals, survey finds 43% of middle-market CEOs expect ‘strategic’ opportunities. (Fortune)

While weary execs appear ready to accept any major narrative so long as it makes sense, uncertainty still clouds the path forward. President-elect Trump's proposed immigration restrictions and international trade tariffs could further tighten an already complex labor market.

Meanwhile, Bank of America analysts suggest December's strong employment figures not only diminish the likelihood of near-term rate cuts but potentially put rate increases back on the table if inflation doesn’t decline to 3% by Q2 . This creates a delicate balancing act for Fed policymakers as they navigate between maintaining price stability and supporting sustainable labor market growth in an environment where traditional economic indicators may be sending mixed signals.

HCI View: Don’t get distracted by promises of another pre-covid bull market. Double check that hiring and spending plans are sustainable even if whispers of new orders and boundless Trump-led growth don’t materialize.

The optimism of CEOs about the economy is likely overstated - which has been shown to affect hiring volumes, urgency of tech adoption, and capital spending.

Companies try to make do without managers

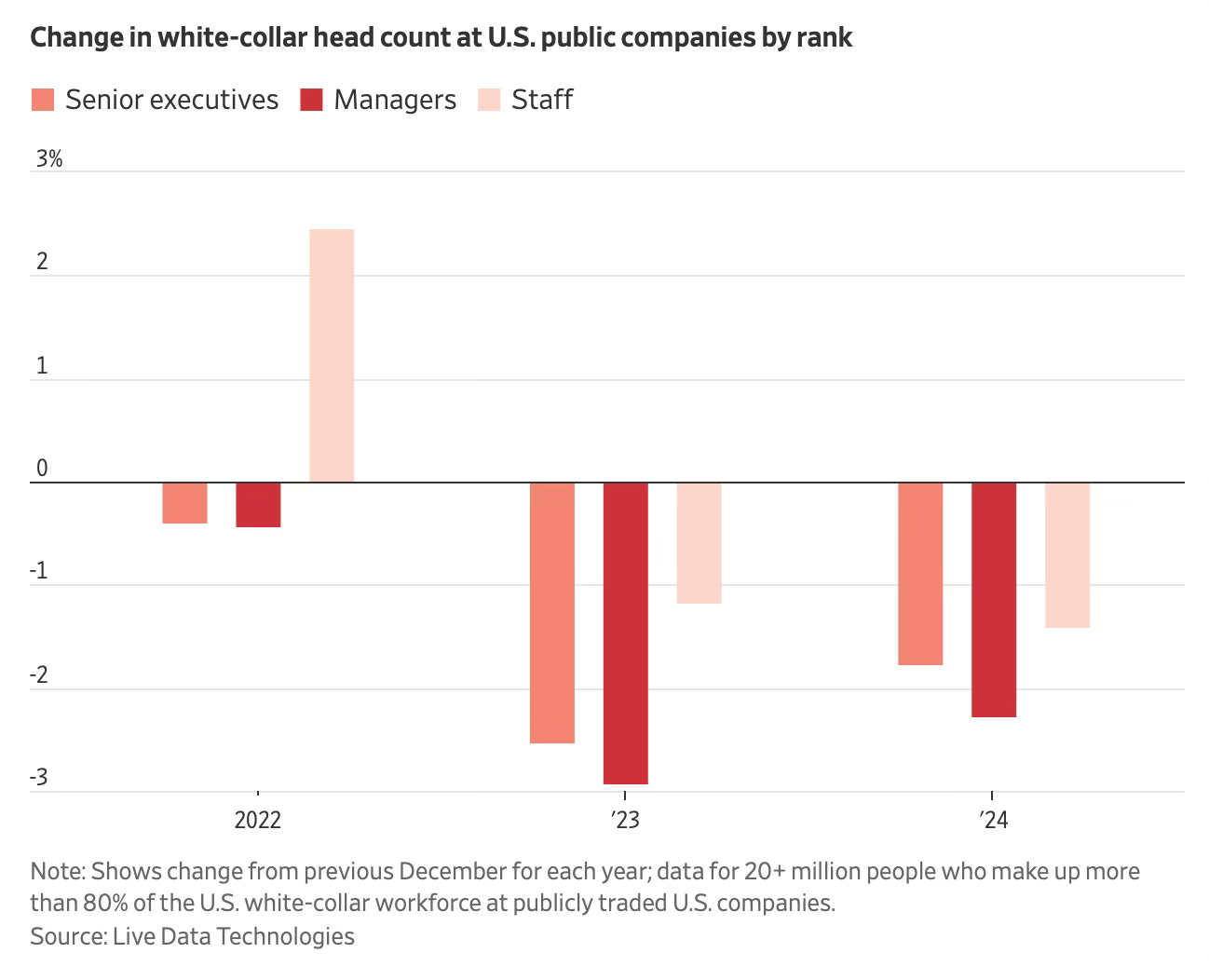

Corporate America slashing its management ranks, with public companies cutting middle-management headcounts 6% since pandemic-era peaks, according to new analysis from Live Data Technologies. The trend spans industries, with notable examples including UPS, Citigroup, and tech giants like Google, which recently announced a 10% reduction in managerial roles.

The implications of this management purge are far-reaching. Managers who remain now oversee nearly triple the number of direct reports compared to 2017, according to Gartner data, while roughly 30% of employees report having bosses too stressed to provide adequate support. The transformation has been particularly pronounced in certain sectors, with human resources departments seeing sharp reduction in headcount since 2022. Former managers are finding themselves in an increasingly competitive job market, often forced to consider significant pay cuts or transitions to individual contributor roles.

The trend appears poised to accelerate with the adoption of artificial intelligence. Gartner projects that over the next two years, one in five companies will use AI to flatten their organizations and eliminate half of their middle-management positions. Some companies are already experimenting with radical approaches - German pharmaceutical giant Bayer has essentially eliminated traditional management layers in favor of self-organizing teams working in 90-day sprints. While such extreme restructuring remains rare, the broader shift away from multiple management tiers appears to be a lasting change in corporate structure rather than a temporary cost-cutting measure.

HCI View: Corporate efficiency drive which “flatten hierarchies”, “unboss employees”, or “reduce indirect labor costs” by targeting managers are nothing new. Yet despite a bump in margins, the ultimate stress, disorder and turnover that occurs without the unsung middle manager has always led to the role’s re-emergence. Just with more things to fix than before. We need better managers, not less managers.

Seriously, does anyone who is managing people think that; A. Strategy is being more clearly communicated to the line than it was 10 years ago or; B. Entry level employees are more capable of directing themselves? Send thoughts or disagreements to ken@stibler.me, I would love to hear counterpoints.

Quote of the Week: Changing Change

We may be entering an era of more pronounced labor-market changes in the US, possibly because of technological disruption brought by artificial intelligence. Data shows that 1990-2017 was the most stable period in the history of the labor market going back nearly 150 years. Since then, economists see indications that the pace of labor-market change has accelerated.

— Working paper by Harvard researchers David Deming, Christopher Ong, and Larry Summers

Reading List:

Despite normalizing averages, many businesses set to see above trend compensation increases

While overall compensation budgets are expected to stabilize in 2025, with employers projecting 3.3% merit increases and 3.7% total salary increases for non-union workers according to Mercer's latest survey, significant sectoral variations paint a more nuanced picture. Tech and finance plan the highest raises while healthcare the lowest of major industries - a complete inversion of what actual labor demand in each industry suggests.

Read More: Rise of the Pips is a reminder to employees that no one is irreplaceable. (The Guardian)

HCI View: As the graph above shows, employees may still be complaining, but they aren’t quitting. Baking in headline compensation averages into salary plans misses the power employers have regained. Of course as JP Morgan is about to find out (below), abusing your power is a great way to keep mediocre employees and lose the great ones.

Big companies renew the push to RTO

Corporate America is kicking off 2025 with an RTO offensive. This week JPMorgan Chase extended full-time office requirement to all 300,000 employees. In a botched announcement, the company was forced to disable its internal comment board after calls for unionization spread in the context of a botched RTO plan which was posted in Bloomberg before sent to employees - no wonder three JP workers HCI talked to already have resumes out. At Amazon meanwhile, employees have just shrugged off the RTO mandate, with some reports showing that office returns are declining just two weeks after the policy went into effect.

Read More: Why some companies are fumbling their RTO plans. (Business Insider)

HCI View: RTO is a convenient way to drive voluntary attrition. Yet the strategy does more long-term damage to trust and culture than the short-term culture hit and cost savings of honest layoffs. With a laundry list of strategic problems, businesses require serious input and commitment from the ranks - it’s hard to imagine any (still unproven) productivity benefits of such public RTO efforts.

If you’re convinced on RTO though, you need to have better reasons that don’t sound like pride-driven ‘executive nostalgia’. Many employees also miss the social scene of the office heyday, so rather than selling the margin boosting benefits of RTO, put it in terms your employees’ self-interest rather than companies, enforce it equally for everyone, and actually create the real collaboration so many employees genuinely enjoy.

Preoccupied with Trump-economy optimism or pessimism? Think again.

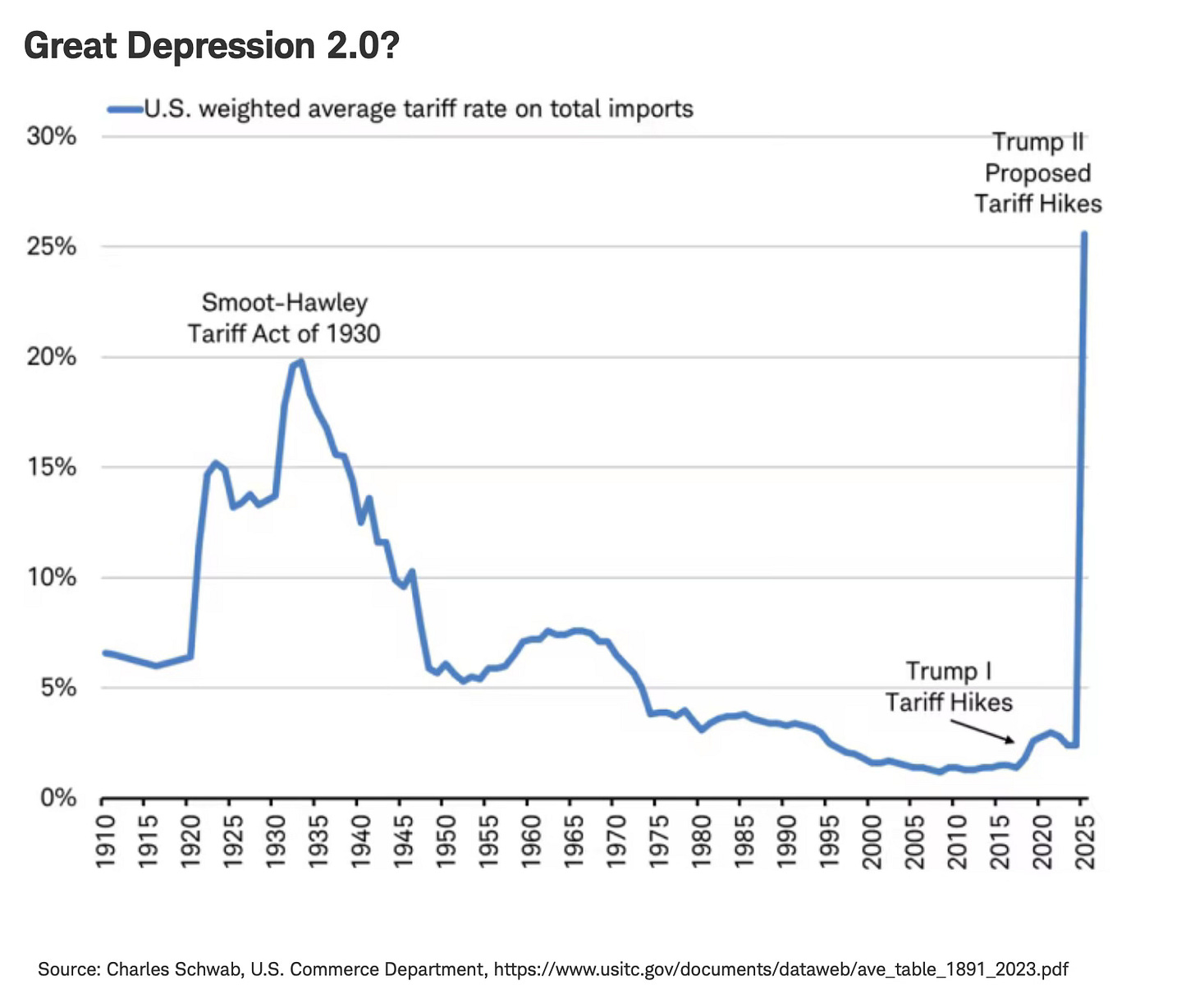

Wall Street's stark divide over Trump's economic impact - with Wall Street celebrating and economists freaking out - reflects a fundamental misread of the incoming administration’s impact. Essentially, economists are taking Trump at his word while Wall Street is betting he won’t follow through. Exhibit A on tariffs:

The economists are very likely wrong here given that from 2017-2021 (with united government 2017-2019) very little got done. Trump’s only legislative win was tax cuts (which will likely be extended), while also losing around 70% of court challenges to executive actions. In politics as in business, transformative leadership has gotten harder as it’s become more important. Expect the courts, rather than Congress, to deliver the major positive changes over the next 4 years while Trump executively de-regulates where he can (tax cuts, lax regulatory enforcement, finance deregulation), but not where businesses need it the most (healthcare costs/insurance, labor/skill shortages, interest rates)

HCI View: As any company in a renewable energy supply chain, immigrant labor dependent business, or trade exposed sector will tell you, it’s better have a plan before you need it.

If you think you are isolated from the ‘news’ just because of size or geography - don’t. Policy changes might hit small B2B firms on a longer lag than the rest of the economy, but today’s policy changes will eventually trickle down, positive and negative.

Data Point:

65%

The percentage of workers declining extra responsibilities according to a ResumeNow survey.

In Other News:

Can Boeing Be Fixed? Aerospace Leaders Offer a Repair Manual - restore trust and forget the stock price. (Wall Street Journal)

Is creative destruction on the decline? Combination of cheap credit and regulatory capture is causing dynamism to decline. (Financial Times)

What’s the difference between ‘time to fill’ and ‘time to hire’? (HR Dive)

Need to Get Noticed at Work? Do This First: Whether you need to pitch or defend yourself, documentation is your friend. (Wall Street Journal)

Illinois law banning caregiver employment discrimination takes effect. (HR Dive)

Family coverage medical care premiums cost employers in small firms $1,232.59 in March 2024. (BLS)

Parents Are Minimizing Work Relationships to Make Time for Childcare. (Harvard Business Review)

Beyond writing job descriptions or tweaking performance reviews, AI is now helping HR wrangle miscellaneous documents and save time. (HR Dive)

Satisfying your next-gen digital workers with an effective Digital Employee Experience (DEX) strategy. (Fast Company)

Intergenerational tensions: Audit firms are struggling to attract and retain Gen Z staff — a key factor in the quality of inspections. (Financial Times)

Great insights, Ken! I especially appreciated the section on 'Companies try to make do without managers.' It highlights the crucial role great managers play in ensuring work gets done effectively. Cutting management layers may temporarily boost margins, but as you pointed out, the stress and disorder it creates often lead to even more short and long-term challenges. We don’t need fewer managers—we need better ones. Keep up the excellent work!